June 15th, 2020

How is Covid-19 impacting B2B & B2C payment trends?

During the pandemic and the enforced lockdown that occurred in many countries, there have been huge changes with Covid-19 payment trends for both B2B and B2C. In this article, we take a look at some of these Covid-19 payment trends and how businesses had to very quickly adapt their model and payment infrastructure overnight. “Bricks and mortar” outlets had to close their doors and people shifted to online shopping for almost every need. We investigate some of these trends and take a look at some of the winners and losers across various industries. We finish by identifying what the payments landscape will look like in 2021 for both B2B and B2C after this crisis.

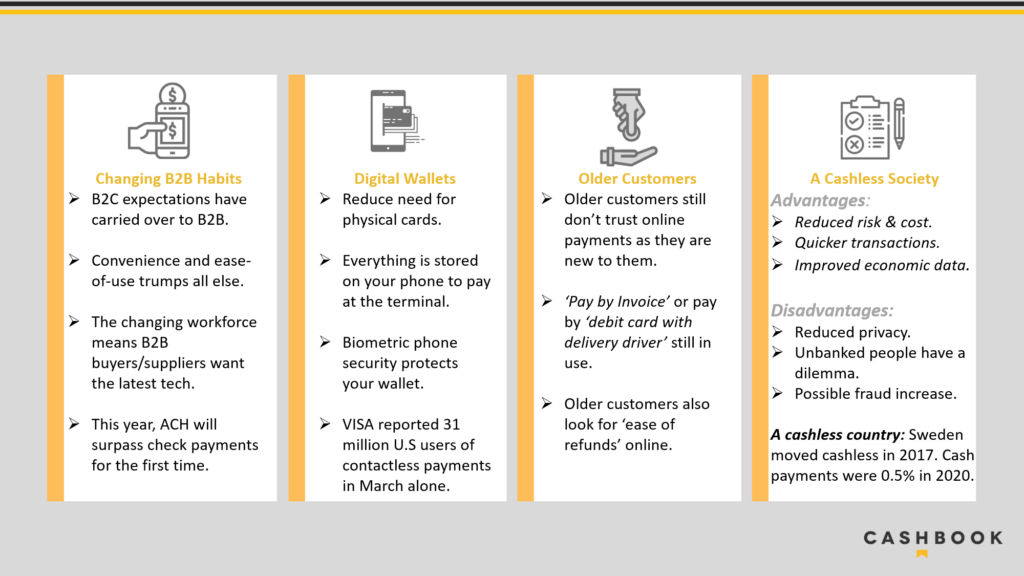

Becoming a more cashless society

As we can below, consumer payment habits have changed due to the pandemic. B2C habits have carried over to B2B, with ‘ease of use’ becoming the new goal. Millennial’s make up a large proportion of the workforce in North America, and they are driving the change online. Checks and cash were being used less and less previously – and the pandemic has further accelerated this trend. ACH payments (digital transfers) look set to surpass checks in the US for the first time ever. More people are making digital and contactless payments now than ever before. People have embraced online banking and digital payments. Older customers have had to break down barriers and use online methods out of necessity. Society is becoming more and more cashless due to digital payments, which brings both advantages and disadvantages. Will more countries follow the lead of Sweden and become cashless?

Increase in online transactions

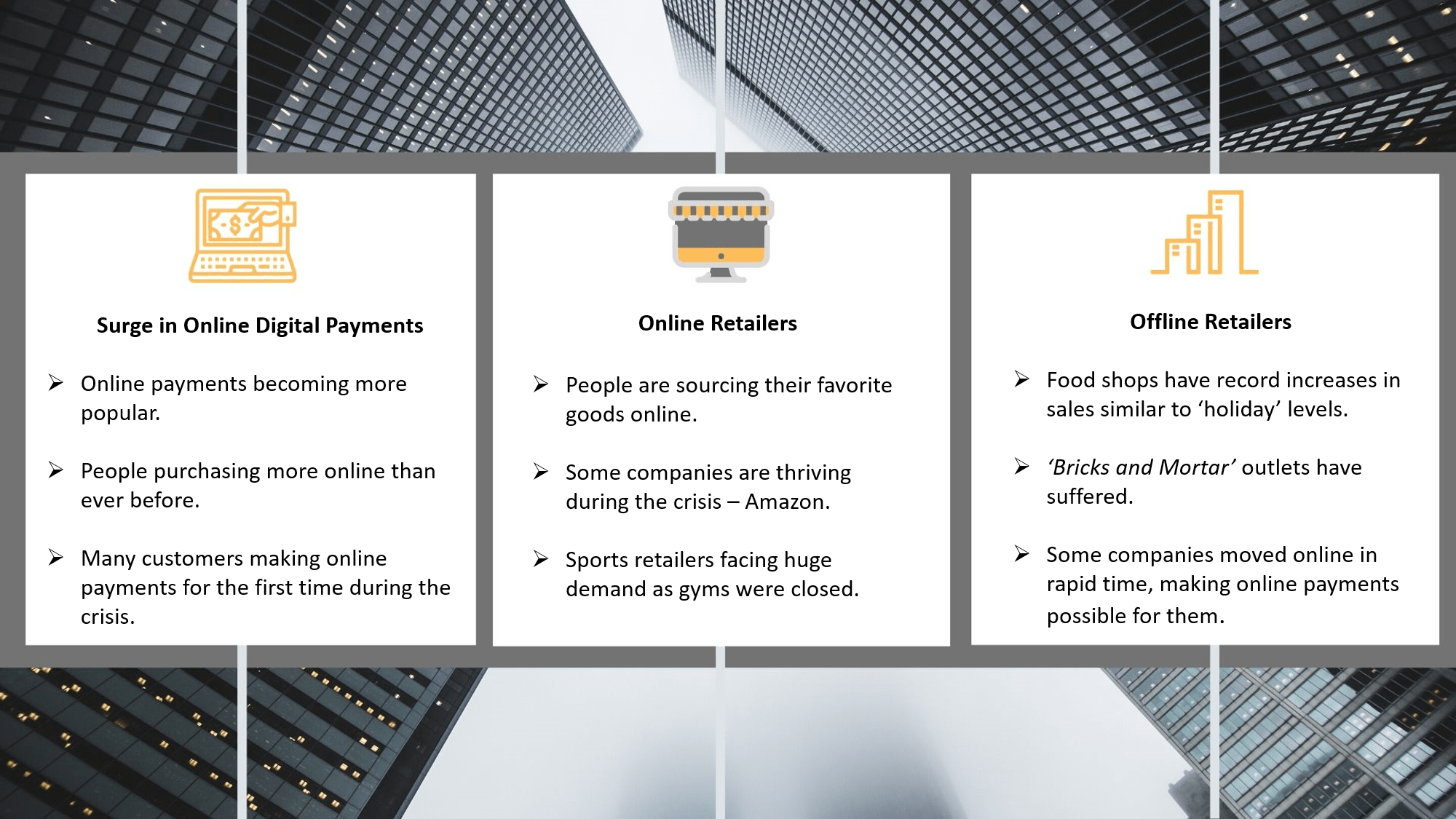

As we see in the image below, there has been a huge surge in online payments during the crisis. With many people purchasing online for the very first time. Wholesaler retailers which had an online presence already have been big winners. A lot of the offline retailers have seen huge increases in sales such as grocery retailers, but many ‘bricks and mortar’ outlets have suffered due to forced closures. Although some have moved their business online in rapid time. A lot of companies are happy to remove paper in this manner, and accept digital payments as the future.

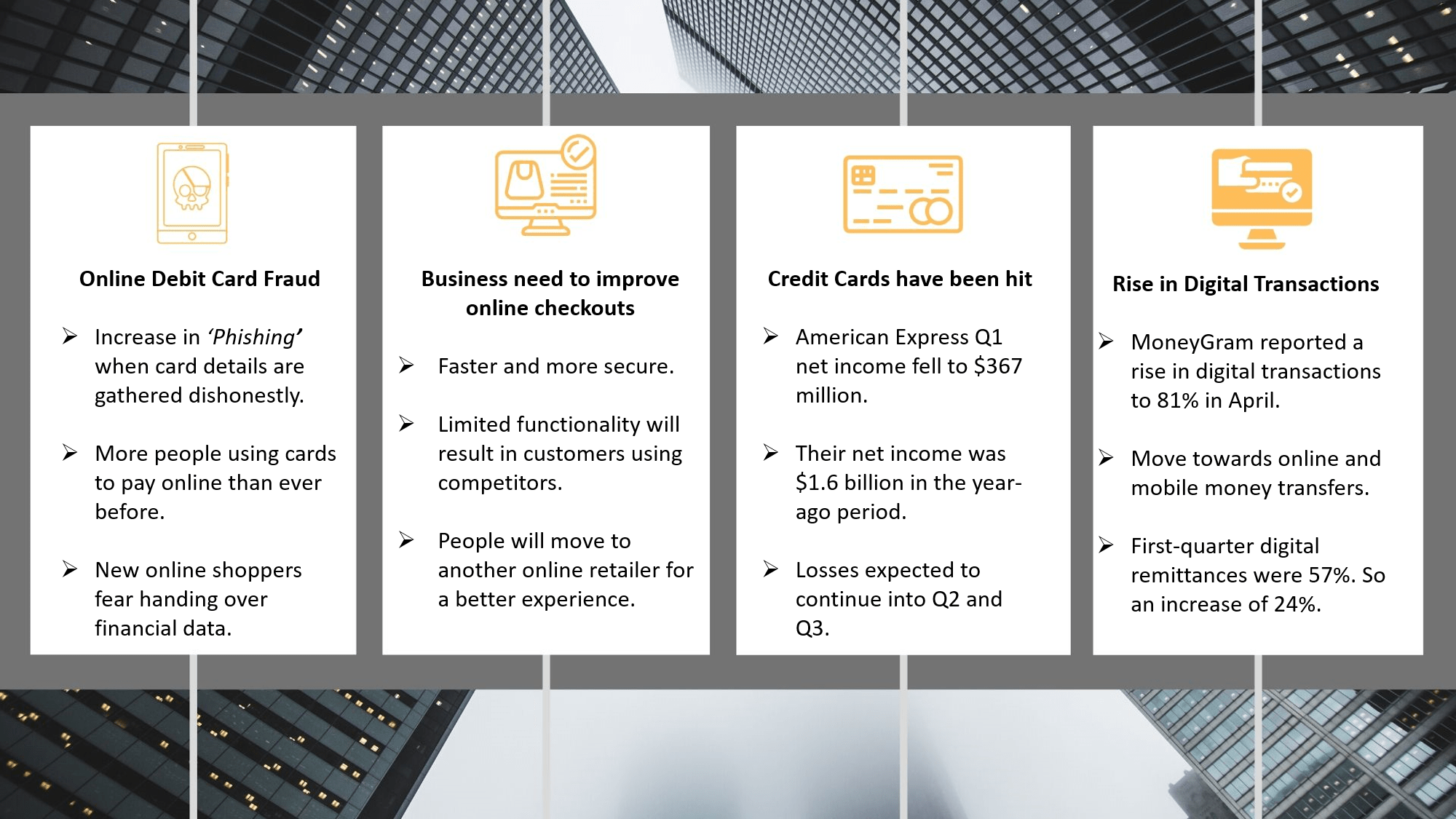

As more payments have been online, there has been an increase in online card fraud. This is why some people don’t trust online payments. As mentioned before, ‘ease of use’ has become paramount and online checkout systems needed to be improved. People just move to another online retailer if they are not enjoying the experience. AMEX reported Q1 credit card traffic and usage is down in the B2C space from 2019 levels. However, we have seen that credit card usage is up in some areas of B2B, such as paying rent for properties in the real estate sector. MoneyGram reported an almost 25% increase in digital transactions in April 2020, compared to last year.

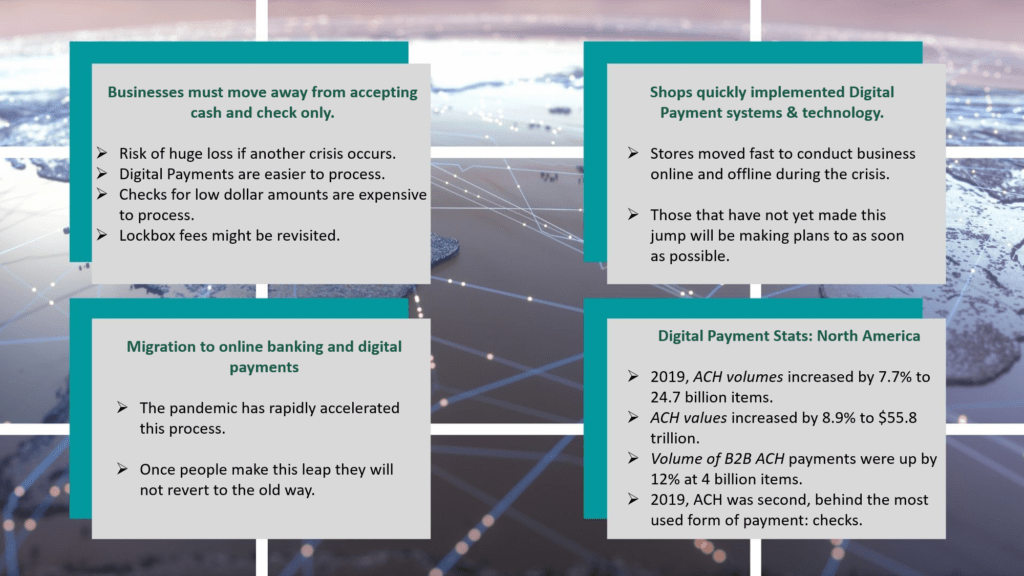

Global rise in digital payment adoption

There is a huge trend towards digital payment adoption by both businesses and consumers. This was already happening in 2019, when ACH volumes increased 7.7% to 24.7 billion items. ACH values had increased 8.9% to $55.8 trillion. The volume of B2B ACH payments were up 12% at 4 billion items. In 2019, ACH was still second behind the most used form of payment – checks. The pandemic has rapidly accelerated this process as people have been migrating to online banking and digital payments. This crisis has proved why it is necessary for them to do so.

Covid-19 payment trends have demonstrated required flexibility in business. Companies need to be flexible and accept more payment types in the future. Otherwise they run the risk of huge losses if another crisis happens. Digital payments are much easier for companies to process than checks. Checks for low dollar amounts are expensive to process. Banks do provide lockbox banking for businesses, where they process checks on their behalf. However, bank lockbox keying fees are hugely expensive for companies that have numerous checks. Although there is lockbox automation software available which totally eliminates these expensive keystroke fees.

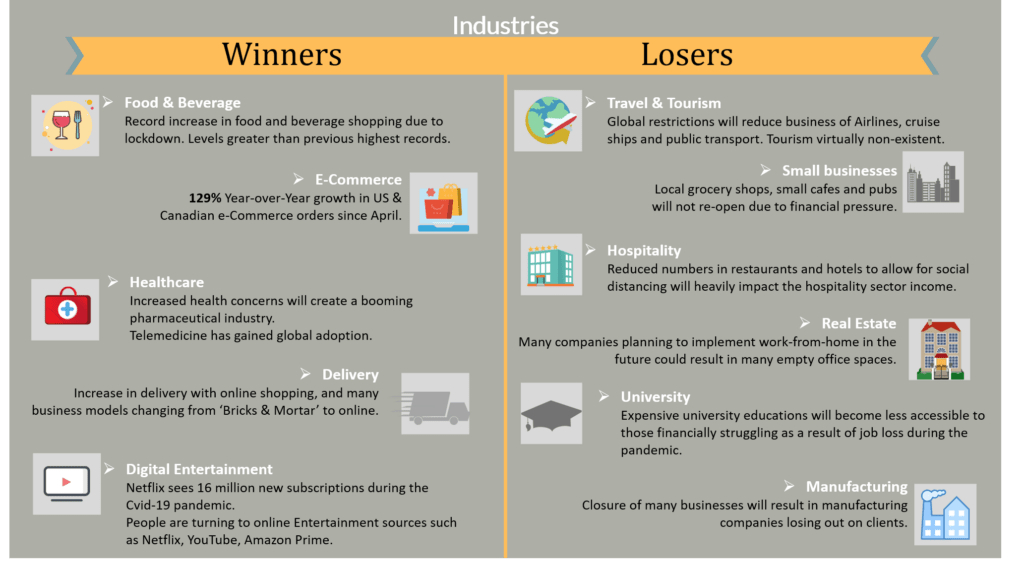

Covid-19 payment trends after the crisis

As mentioned previously, there have been some winners and losers from the pandemic. These are broad strokes as certain businesses within the sector may have seen an increase while others may have suffered. Below, we can see that food and beverage retailers have gained, although restaurants and cafes will have suffered due to closures. E-commerce orders in North America have seen a 129% year-on-year growth in April. Healthcare is obviously booming as hospitals and general practitioners have been very busy, and products around the prevention of the virus became a necessity. Deliveries and digital entertainment have seen massive increase in usage over the past 3 months, mainly due to online shopping and lockdown boredom respectively.

The big losers are travel & tourism including hospitality. These sectors ground to a halt due to an international travel ban and a lockdown in multiple countries. Manufacturing also ground to a halt for an extended period of time, none more importantly than in China, which manufactures so many products for companies all over the globe.

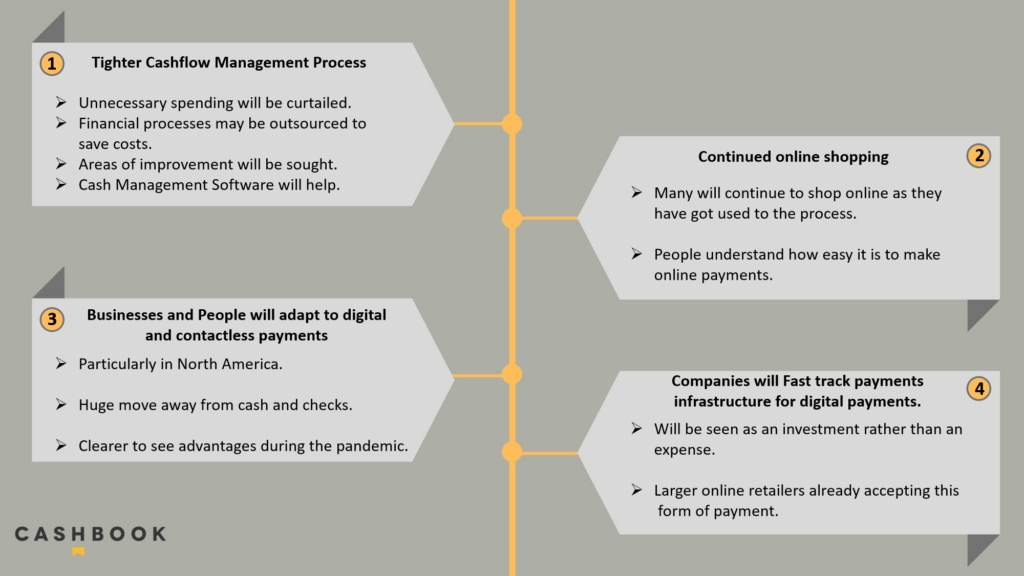

What will the payments landscape will look like in 2021?

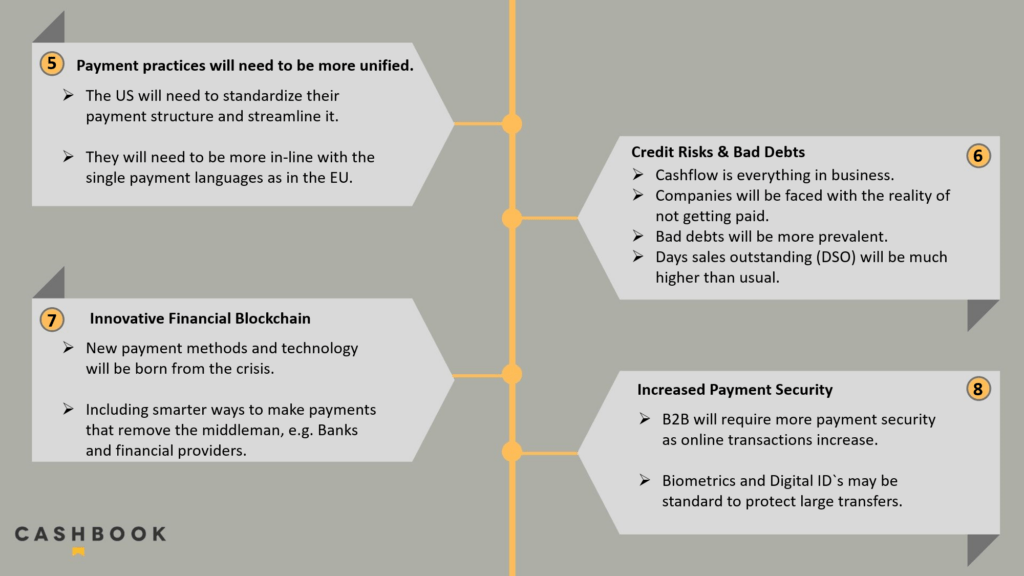

When businesses get back to work fully, will the changes made during the crisis still be relevant? In the first point below, there will be much tighter cashflow management. Every expense and payment will be reviewed to see if it’s absolutely necessary. Outsourcing may also be introduced to save costs. Businesses that did not move online or change their payment infrastructure will now need to move fast. Cash Management software will become popular due to increased digital payments. Online shopping will continue to boom with more users than ever before.

Payment practices will become more unified around the world. More standardization is needed in the US. The European Union has examples of this with SEPA and ISO 20022. Also, the Payment Services Directives 1 & 2 which provide a more integrated and streamlined EU payments market. They increase competition and participation in the EU payments industry from non-banks. This affects the payments of over 1 billion people all over Europe.

New blockchain payment methods can also be born from this crisis. Technology that help businesses to move online quickly and accept digital payments have been huge winners. There will be a lot of credit risks and bad debt as companies look to bounce back from huge losses. Banks and other intermediaries will help here with credit along with most governments who also gave financial supports to small businesses. We will also see more payment security which should be automatically improved during the standardization of payment practices.

Conclusion on Covid-19 payment trends

Overall, the pandemic has had huge impacts on B2B and B2C payment trends worldwide. It will be interesting to observe these key Covid-19 payment trends in a post-pandemic world. We know that a lot of these necessary changes will be around for many years to come. Such as the move to a more cashless society; a new trust in online shopping; the many different ways for people and business to make & receive payments; the increasing rise of digital payments over cash and checks, and the need for more standardized global payment practices.