June 12th, 2020

Changes in payment trends over the last 10 years

The history of payment trends

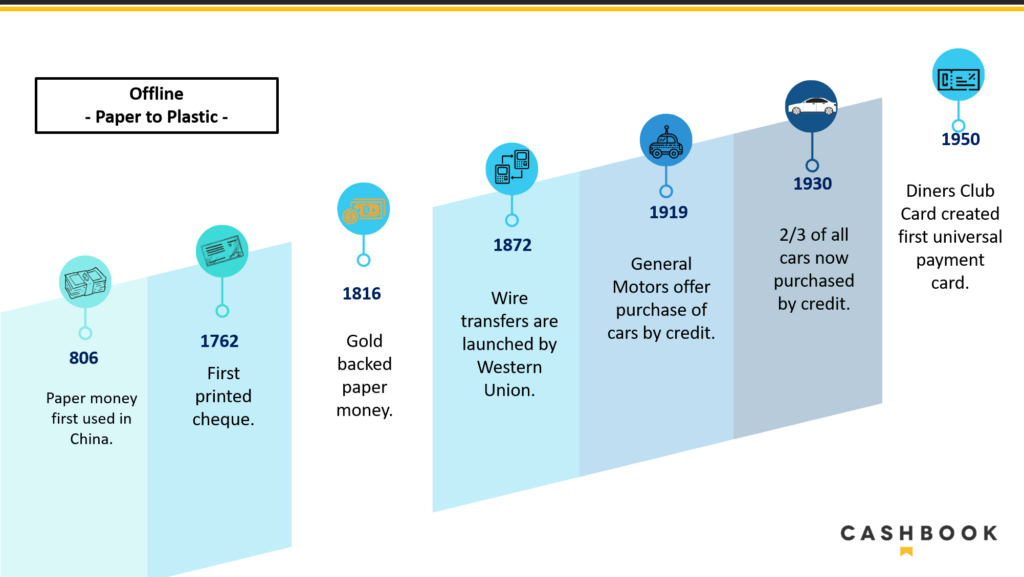

Paper to Plastic

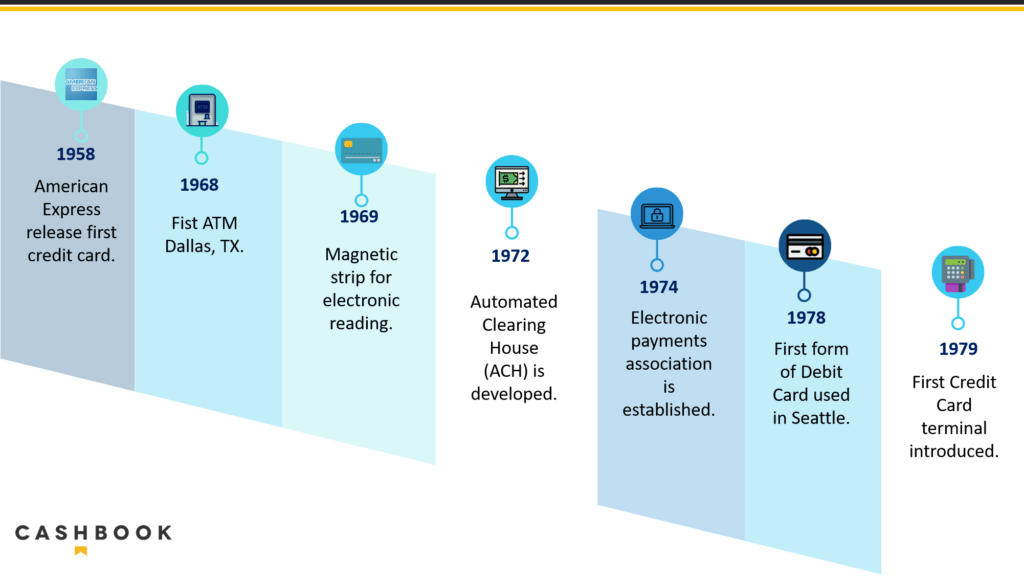

Payment trends have changed hugely in the last 10 years, before we examine that time period, we will quickly look at the evolution of payments throughout history. Payments have changed fundamentally down the years. In the two images below, we can see the evolution from the first paper money used in the year 806, right through to checks, wire transfers, credit payments, and finishing with numerous methods of plastic payments up to 1979.

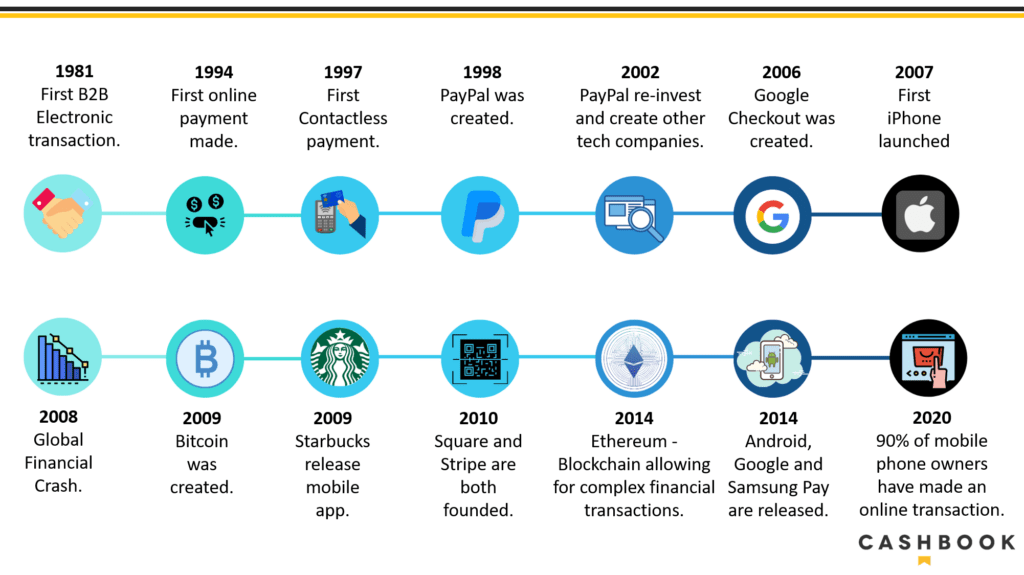

Online Payments

Once the internet was developed and business started to move online, payments soon followed. In the image below, we can see that the first B2B electronic transaction was made in 1981. The first online payment made by a customer was in 1994, after the internet became available in 1991. Amazon, Google and PayPal were founded thereafter and the e-commerce world became much more accessible. Online payments were simple, easy and more secure. The arrival of the smartphone in 2007, meant that people had the ability to purchase online directly from their pockets without a PC. Payment trends were about to transform. This brought an increase in payment regulations.

Increased Regulatory Requirements

Europe – The Payment Services Directives 2007 (PSD1) – was created to produce a more integrated EU payments market. It made payments safer and more secure for consumers. The updated PSD2 followed in 2015 – this was developed to increase competition and participation in the EU payments industry from non-banks. This update included more security and expanded privacy. The PSD2 affects the payments of over 1 billion people in Europe.

US – The Fed governs all payments in the US and it is quite a complex system. The US Central bank plays a significant role in the payment system, through interbank payment services. Financial institutions are chartered at state or federal level, and supervised by one or more agencies. There are a variety of payment instruments and settlement mechanisms, to discharge payment obligations between financial institutions and customers.

FedNow – The US are currently looking to modernize their payments system with ‘FedNow’ – it would still operate in conjunction with other services in the private sector. Meaning it would not be a single unified payments service. Presently, institutions from outside the US such as non-banks need to co-operate with banks to gain access to the payments system. They are hoping ‘FedNow’ will change all of that and deliver faster payments. However, it could take up to 5 years to develop and implement. The US are looking at recent updates to other global payment processes, such as those completed in Europe.

Evolution of Electronic Payment Trends

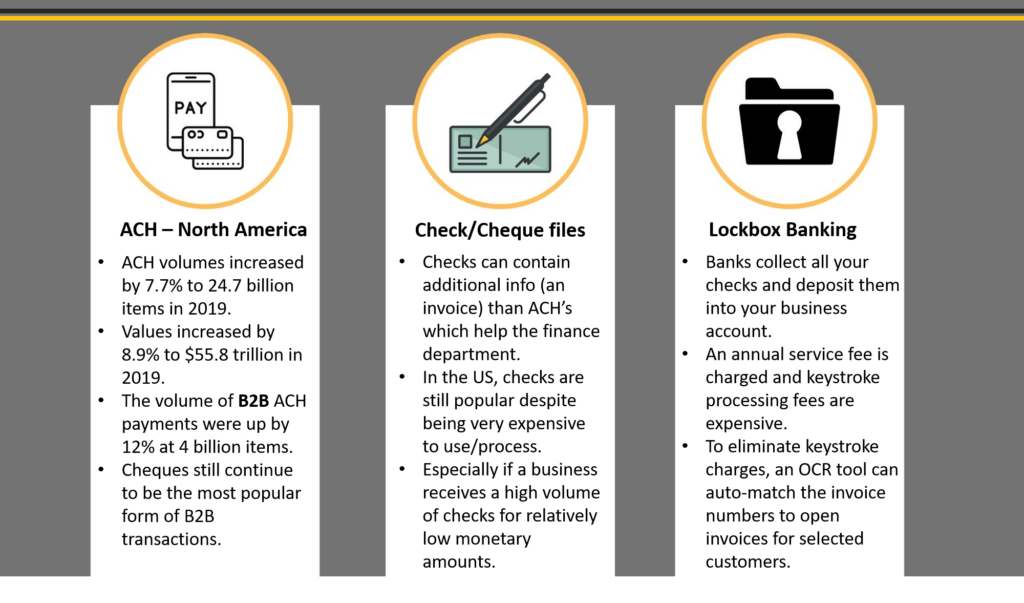

Electronic payments have really increased over the last 10 years in the United States. ACH payments (electronic transfers) have increased year on year over the last 5 years. ACH’s are now starting to rival the most popular form of payment – checks. In the next few years, ACH payments will surpass checks and become number one as we can see from the figures below. Checks are still widely used however, and banks do provide a service called ‘Lockbox Banking’ to process checks for customers. Banks will collect your checks from a designated address, process them and deposit to your business accounts. This process can be quite expensive due to bank lockbox keying fees.

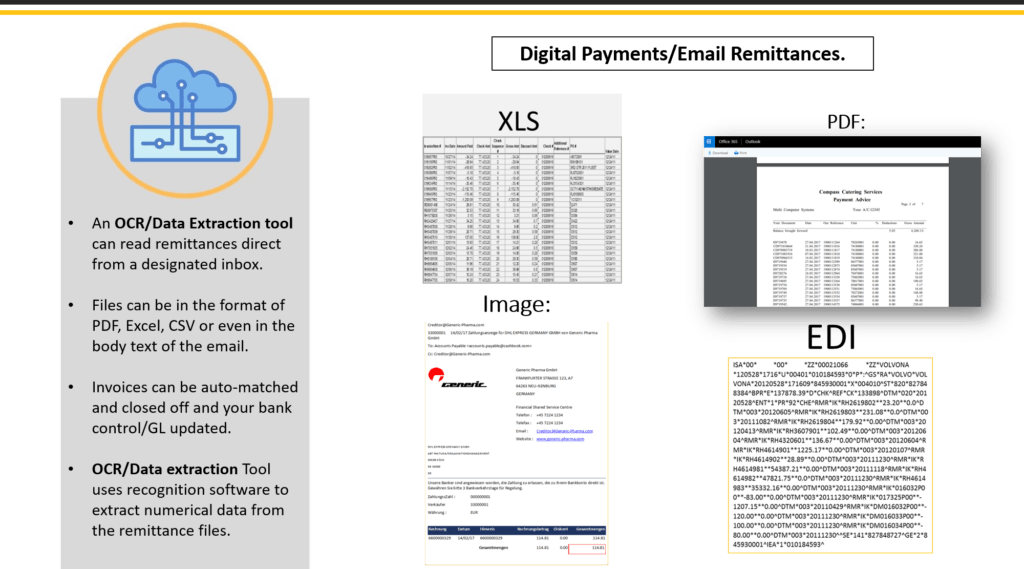

Although advances in cash automation allow for these keying fees to be eliminated, mainly with the use of an OCR/Data Extraction software tool. This tool extracts numerical data from remittance files and digital payments/email remittances. The OCR/Data Extraction tool can be used to automate remittances in multiple file types, leading to huge savings for a finance department.

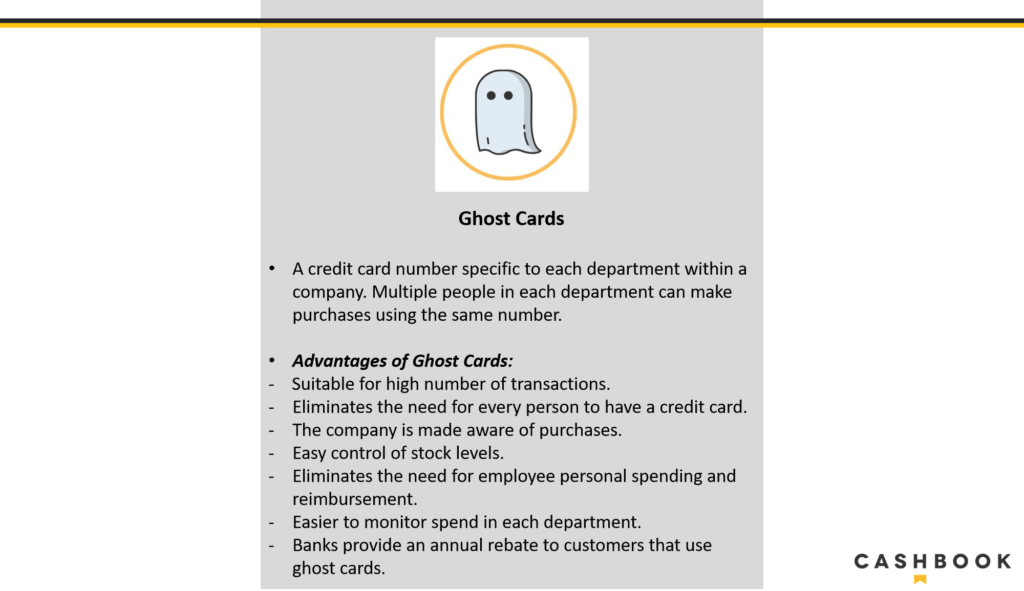

‘Ghost cards’ are also used in large organizations for making payments more simplified across various departments. Ghost cards lead to a significant number of key advantages as listed in the image.

Mobile Technology Payment Trends

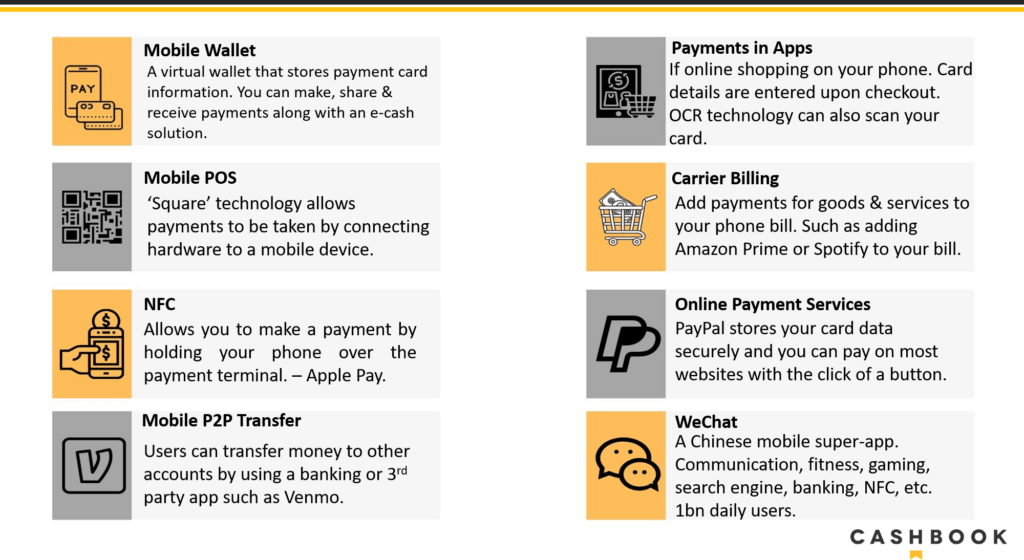

As we mentioned earlier, when smartphones became available in 2007. They opened up the world to increased online payments. This led to huge developments in mobile payment technology and infrastructure in a very short space of time. In the image below we have detailed some of these developments.

Cryptocurrency

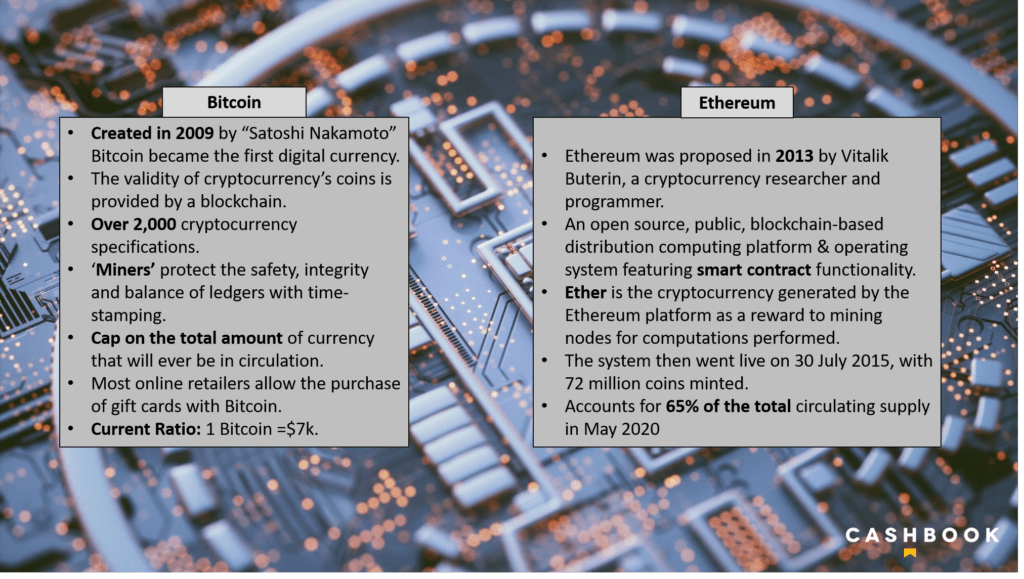

In 2009, we saw the creation of Bitcoin, the world’s first digital currency and it used blockchain technology to come into existence. Cryptocurrency is used as a decentralised form of digital currency. This paved the way for people to make payments in a different way. Ethereum followed in 2013, which contained ‘smart contract’ functionality and ‘Ether’ was the name given to its digital currency. There are over 2,000 cryptocurrency specifications in the world today. Most large online retailers now allow the purchase of gift cards via digital currencies.

The Blockchain Revolution

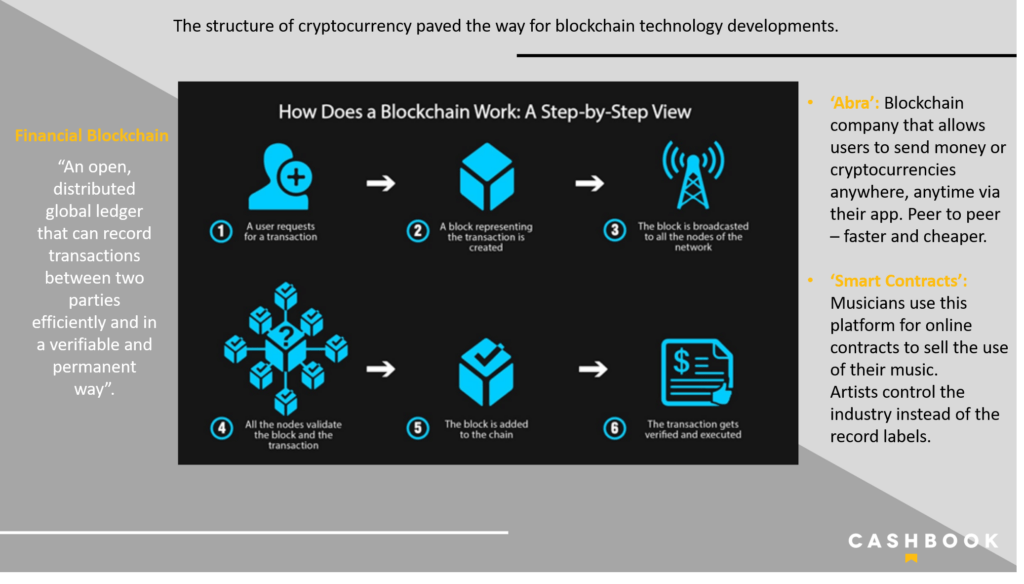

The structure of cryptocurrency paved the way for financial blockchain technology developments. It allows for new ways of payments to be made without the need for intermediaries such as banks. Meaning, you don’t need a bank account and it is peer to peer. A financial blockchain is defined as “an open, distributed global ledger that can record transactions between two parties efficiently and in a verifiable and permanent way”.

Blockchains are secure by design, and are an example of a distributed computing system with high fault tolerance. Decentralized consensus has been achieved with a blockchain. Blockchain technology has managed and distributed more than $270bn. The Blockchain market size is predicted to be worth $60bn by 2024. An example of a blockchain company is Abra, which can be seen below. Along with an explanation of how smart contracts are used.

- Abra: a blockchain company that allows users to send money anywhere, anytime. Abra has peer-to-peer capability which allows users to instantly send and receive money (fiat or cryptocurrencies) via an app to anyone, anywhere in the world. It’s faster and cheaper than the usual financial intermediaries such as banks or money transfer.

- Smart Contracts – Musicians are using this technology for online contracts to sell the use of their music for different mediums – ads, business, movies, ringtones, etc. Different prices for each, all done online using blockchain technology. This means the artist controls the industry instead of the record labels.

Race to a cashless society

A cashless society describes an economic state whereby financial transactions are not conducted with physical banknotes or coins. But rather through credit and debit cards, mobile wallets, payment apps, internet banking, cashless point of sales (POS) systems, and other forms of digital payments. We are seeing this more and more with the evolution in payment technology.

EU Citizens are increasingly using cards for payments, the Nordic countries are the highest users here. In 2017, cash payments in Sweden accounted for only 15% of the total transactions.

Advantages of a cashless society

- Reduced Business Risks and Costs – reduced cash in-store, less cash counting & trips to the bank, reduction in fraud and burglary.

- Transaction speed – greatly increased, better for busy outlets – that can process customers faster.

- Improved Economic Data – better collection due to increased card transaction data.

- Money laundering and Tax evasion – reduction in this due to clear paper trail.

Disadvantages of a cashless society

- Privacy – if all of your transactions can be traced, then we are in a big brother situation.

- Fraud – if more businesses have your card details, it increases the chance of them being stolen.

- Losing wallet/digital wallet – a headache to replace your cards but at least no cash is gone. Losing your phone, which is your digital wallet, can be expensive to replace.

- Unbanked People – can be problematic for people that rely on cash and don’t have a bank account or cards.

Along with the benefits, Sweden has also seen problems due to 85% of all transactions being non-cash based. Cash-free bank branches have been introduced with mixed reactions. Especially from the older generation. Smaller businesses depend on cash and expensive merchant services can be costly. Any downtime in technology can have a negative effect. It will be interesting to see if more countries, like Sweden, move towards a cashless society.

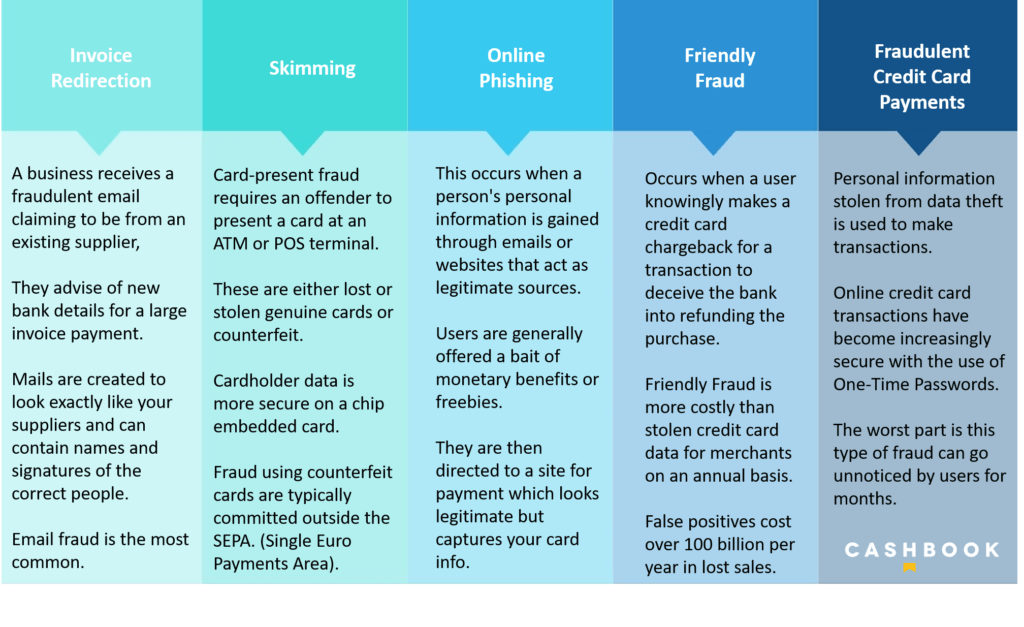

Payment Fraud

As we can see below, there has been a huge increase in payment fraud and different types of fraud over the years. Especially, when online payments became more commonplace. The global cost of fraud is not millions or billions but trillions each year! In fact, it was €4.6 Trillion or $5 trillion USD in 2019 alone.

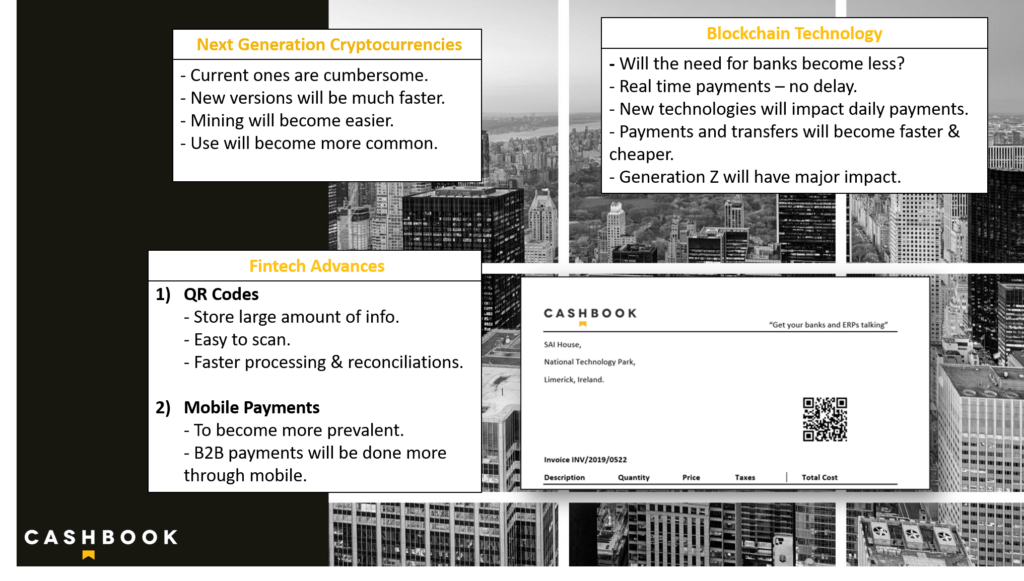

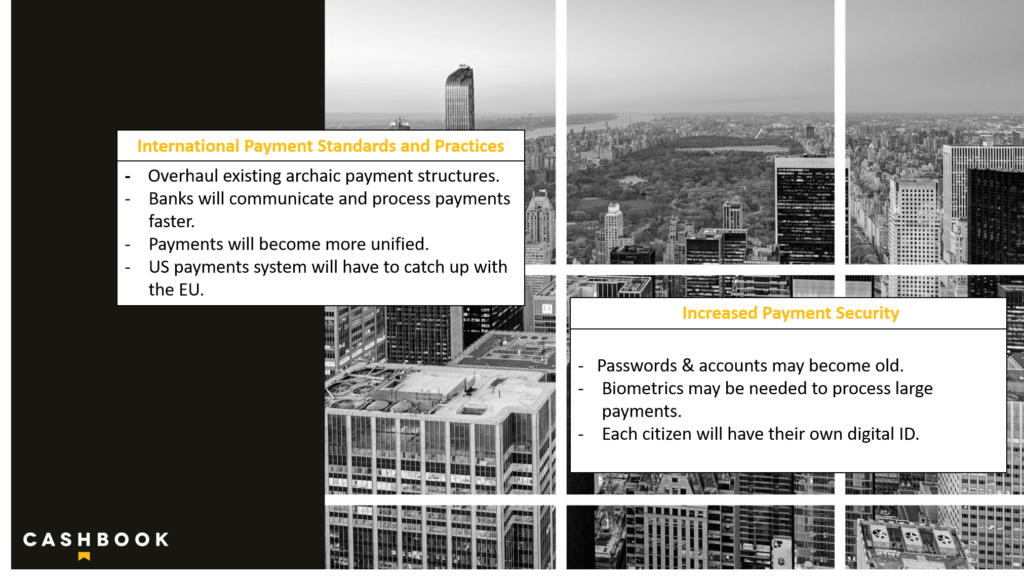

The future of Payment Trends

In this article we have looked at the history of payments; payment regulation; electronic payments; mobile payment technology; cryptocurrencies; the blockchain revolution; payment fraud and a cashless society. Finally, we look at the future of payments. Below, we have listed some of the payment developments that could be the next big thing.